Proactive Pacing: When to Activate Demand Before You Drop Rates

When properties underperform, most managers drop rates. But weak pacing is usually a visibility problem, not a pricing problem. And if you drop...

Discover how BookingsCloud’s advanced property scoring, smart spend allocation, and data-driven advertising can optimize your marketing efforts and drive results.

BookingsCloud is designed to support vacation rental managers, owners, and marketers with tailored solutions to boost efficiency, control spend, and increase bookings.

Access guides, case studies, and expert resources to help you maximize the potential of BookingsCloud and stay ahead in vacation rental marketing.

Table of Contents

For years, vacation rental managers have treated Airbnb commissions like utilities: fixed costs you can't control.

But this fall, at conferences like the Women’s Summit and VRMA, we talked with dozens of managers who are waking up to the fact that Airbnb fees are actually your marketing budget.

And the moment you realize that, you start asking much harder questions about where that money should go.

This article will show you what Airbnb fees actually cost — and how to start making more intentional decisions about your marketing budget.

Note: While we’re focusing on Airbnb here since it’s the platform most hosts start with, everything we’re discussing applies equally to Vrbo, Booking.com, and other vacation rental booking platforms (collectively called OTAs, or online travel agencies). The principle is the same: these commissions represent marketing dollars you’re spending by default, not fixed overhead you can’t control.

Traditionally, Airbnb commission fees were split between the host and the guest. But as of October 2025, any host who uses property management or channel management software (in other words, almost every professional manager) will shoulder the entire fee — now a flat 15.5% service fee deducted from the total booking value, including rent and cleaning fees but excluding taxes.

Let's make that concrete. If you're managing 75 properties generating $2 million in annual revenue from Airbnb bookings, that's $310,000 going to Airbnb each year. For most vacation rental businesses, this margin loss is significant.

The change from split fees to host fees (and the extra .5% Airbnb has tacked on for good measure) isn’t the problem. Hosts can make up that difference by raising their rates, and guests pay roughly the same total amount. And Airbnb plays a valuable role — especially for smaller operations, the platform provides immediate access to millions of travelers without upfront cost. That’s genuinely valuable when you have little brand recognition.

But the change has started shining a light on a long-overdue conversation in our industry: Airbnb fees aren't "distribution cost." Like any other marketing dollar, they’re part of customer acquisition cost (CAC).

For years, most vacation rental managers have used this method to calculate marketing costs:

And this is exactly what Airbnb wants. Because if you aren’t calculating your true CAC, including platform fees, you’re underestimating what it really costs to bring in a guest.

Instead, here’s a better way to think about customer acquisition costs:

Ultimately, CAC is just a way to measure what it really costs you to bring in each new guest. Take all your sales and marketing expenses (ads, software, agency fees, *and* platform commissions) and divide by the number of first-time guests you gained.

(Note: This is not about returning guests. CAC is strictly the cost to acquire new ones.)

When you don’t know your full acquisition cost, you can’t compare CAC by channel (Airbnb vs. organic search vs. paid social). And that leaves you in the dark about which channels are actually more efficient at acquiring new guests.

But when you reclassify those fees as marketing spend, you see the real cost of growth. And you start to think about where you can shift budget into more sustainable direct channels.

This is what the hotel industry started doing a few years ago — and it’s time for short-term rentals to catch up.

Again, let's say you manage 75 properties generating $2 million in gross revenue annually. Your marketing budget might be:

You only control $125,000 of that spend. The other $310k? You've outsourced those decisions to Airbnb and other OTAs.

Recognizing Airbnb fees as marketing spend isn't semantic. It's strategic.

It forces you to ask whether this is the best use of your marketing dollars, and opens up alternatives you actually control — like direct booking.

Because that 15.5% is only the tip of the iceberg.

Beyond the commission percentage, Airbnb dependency costs you three things that directly impact your ability to build a sustainable business: control, customer data, and repeat business infrastructure.

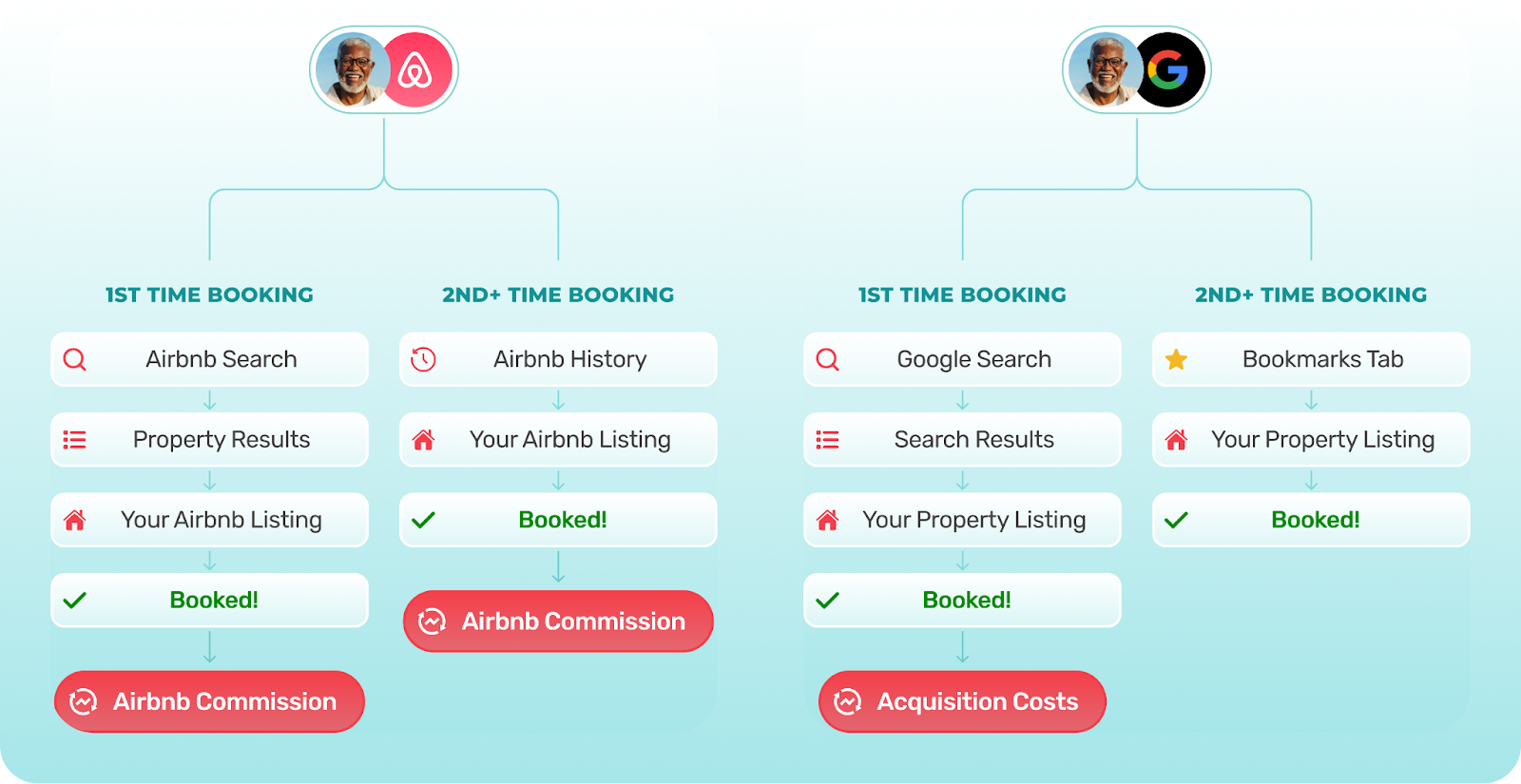

In other words, a guest who books with you three times via Airbnb represents three separate commission payments, when you could have only paid once to acquire them directly.

Direct bookers cost you nearly nothing to “re-acquire” after that first booking. You can remarket to them for pennies through email and social media. The lifetime value economics aren't even close.

This is why Airbnb and other platforms should be one channel for new guest discovery, not your entire strategy. The goal isn't to cut platforms out completely. It's to stop thinking of those fees as fixed overhead and start seeing them as redeployable marketing fuel that can fund direct acquisition you control.

Understanding that Airbnb fees are marketing spend is only valuable if it changes your behavior. Here's how to start making intentional decisions this quarter.

Add up *all* costs: Airbnb and platform commissions (both host and guest sides) + ad spend + salaries + tools. Divide by the number of first-time guests you acquired.

Now segment by channel. What does a new guest cost via Airbnb versus Google Ads versus your direct website?

This is your baseline.

What percentage of bookings should come from channels you actually control?

Think of your marketing strategy as a four-legged stool. Each leg represents a booking source: Airbnb, Vrbo, your direct website, and repeat guests. Now picture what happens if one leg cracks: Airbnb changes its algorithm or Vrbo demand in your market slows. Does the whole stool stay standing, or does it topple?

Diversification means that if one channel stumbles, the others keep your business stable. But if 80% of your guests come from Airbnb, your business is at constant risk.

Direct acquisition is especially crucial, since it doesn’t just protect your margins but also gives you repeat guests and referrals.

Use a portion of your platform spend to fund direct acquisition strategies:

Track CAC by channel monthly. Measure which channels drive the most repeat bookings. Look at customer lifetime value, not just first booking revenue.

Then shift your budget toward channels with better economics over time.

This mindset shift is already happening as forward-thinking vacation rental managers are finding ways to take back control of their marketing spend.

For example, a management company in Hilton Head, South Carolina saw their direct bookings skyrocket from 5% to 34% after automating paid social campaigns with BookingsCloud.

That greater control translates to:

Ultimately, the company has realized a 3% higher margin thanks to shifting marketing dollars away from third-party platforms and onto targeted direct advertising.

The difference between treating Airbnb fees as fixed overhead and treating them as marketing spend is the difference between building someone else's business and building your own.

This isn't about demonizing Airbnb or other platforms. They serve an important purpose, and they've democratized access to guests in ways that didn't exist before. But it’s time we started making intentional choices instead of default ones.

Tools like BookingsCloud help property managers understand and optimize their customer acquisition costs across channels. But first, you need to know what you're actually spending.

Start this week: calculate your true CAC including all platform fees. That one number will change how you think about every marketing decision you make.

And if you want to learn more about direct acquisition channels and owning your customer relationship, let’s talk.

When properties underperform, most managers drop rates. But weak pacing is usually a visibility problem, not a pricing problem. And if you drop...

For years, vacation rental managers have treated Airbnb commissions like utilities: fixed costs you can't control. But this fall, at conferences...

Every short-term rental manager knows they need more direct bookings. Your OTA commissions are eating into margins. Algorithmic changes are...